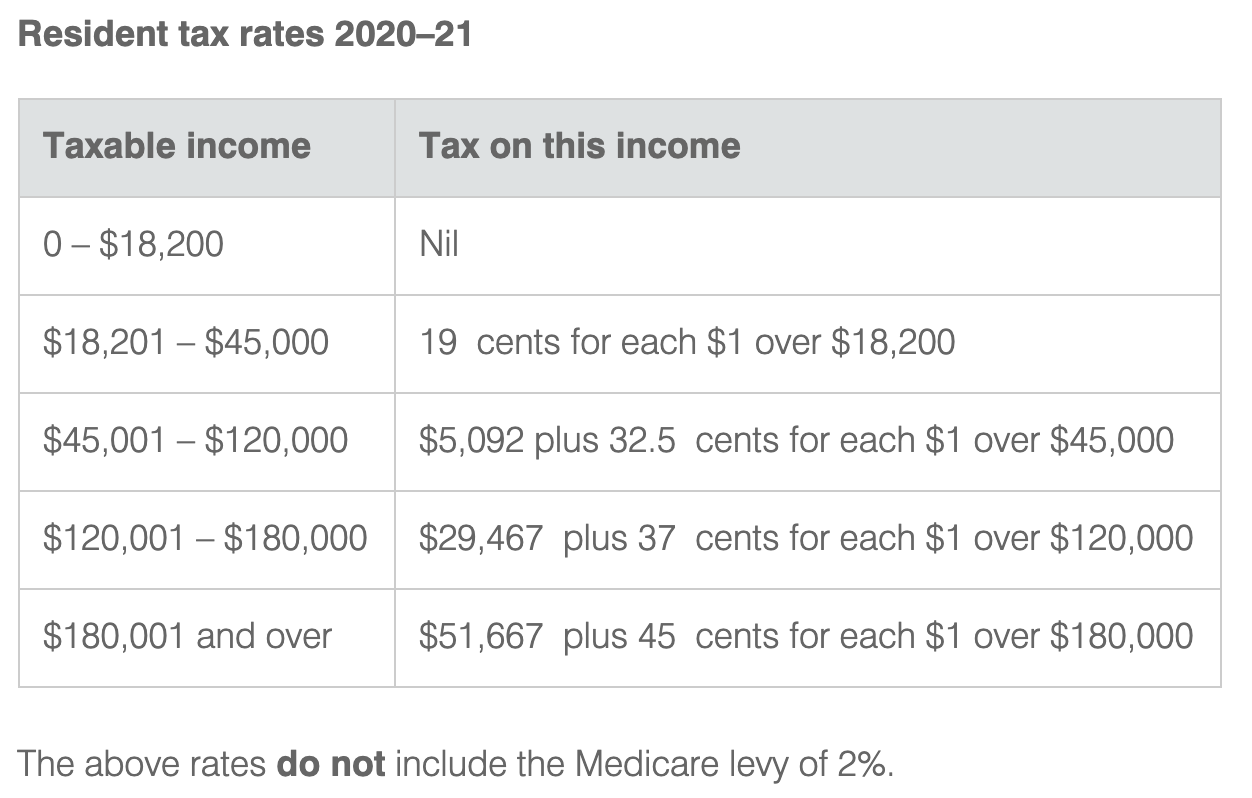

The Tax office has updated its withholding schedules and tax tables, reflecting new personal income tax thresholds. The changes will apply to payments made on and from 13 October this year. Employers have until 16 November 2020 to implement the adjustments.

While the tax cuts have been backdated to 1 July this year, the tax table changes do not take into account any over-withheld amounts. The individual taxpayers have paid since the start of the financial year.

However, the over-withheld amount will be factored into the tax assessment of an individual at the end of the income year.

To view the updated tax tables, click here.