With the growing number of data breaches exposed over the last few months, now is the time for all individuals to ensure they are being hyper-vigilant with their personal data.

We need to start creating a cyber safety-aware culture amongst individuals and small business owners and for every person who is online to understand how to identify fraudulent information requests.

Scammers don’t discriminate and will target anyone regardless of their background, age or income level.

Our personal information is any information that can be used to identify us online. This can include:

- Full name

- Date of birth

- Current address

- Bank account numbers

- Credit card details

- Tax file number (TFN)

- myGov and ATO online login details

- Driver’s licence details

- Passport details

- Passwords

With everything going online, our data is being stored in various places, including web applications, social media platforms, ad networks, employers, or healthcare providers in different servers worldwide. People are starting to have less and less control over who can access their personal information.

What can you do?

The greatest advice that can be given is to simply be aware of what you share online and always be cautious when your personal information is requested.

So, what can you do to attempt to combat your personal information being misused?

First, be aware that scams exist. If you receive any unsolicited contact via phone, email, mail, in person or via a social networking site, always consider that this could be a scam.

Scammers are becoming more savvy, and they continue to succeed because they look like the real thing. Just remember, if it is too good to be true, then it probably is.

What is the ATO saying?

There are also multiple steps you can take to enhance your cyber safety. These include: turning on automatic software updates, switching on multi-factor authentication, regularly backing up your devices, using passphrases, securing mobile devices, and watching out for cyber scams. If you want to learn more about what you can do to protect your small business online, you can check out the Australian Cyber Security Centre’s Small Business Cyber Security Guide.

The ATO has broken down cyber safety into three easy to follow steps.

- Update your devices and applications

Cyber criminals love to find ways to hack known weaknesses in systems or apps. Regularly check for updates to stay one step ahead.

2. Turn on multi-factor identification

Multi-factor authentication (MFA) is when you require two proofs of identity in order to grant access. The second is usually sent to something physical that you also have access to such as a phone, email or token. Without this the cyber criminal will be locked out of the account.

3. Backup your files

The most popular way to backup files now is using a cloud storage service. This works by storing a copy of all your files in an external storage. Setting up automatic backups is a great option as you can recover important files if something goes wrong.

All too often we don’t take our cyber security seriously until it is too late. It doesn’t take long to steal your identity, but it sure takes a long time to fix it!

Recent ATO scams

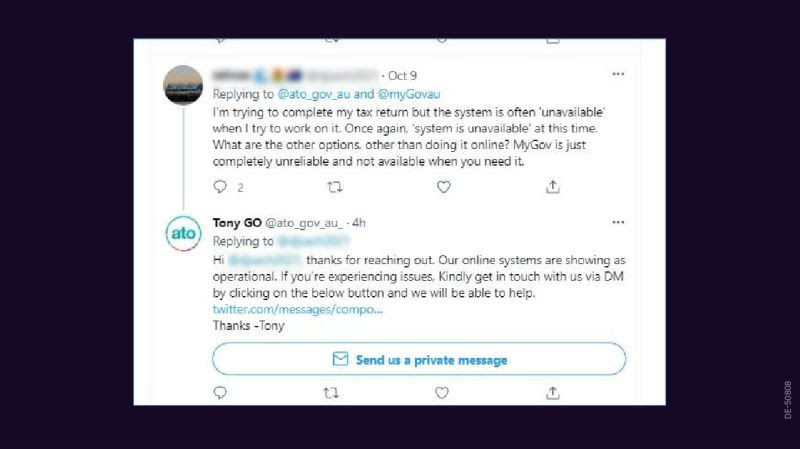

The ATO has recently seen an influx of social media accounts impersonating them.

Here is an example:

If you’ve received a message from the ATO and you’re not sure it’s really them:

- Look for the official ATO logo and organisational name next to the message. Beware of slight variations on the name, like ‘Australia’ rather than ‘Australian’ Taxation Office.

- Check the date the messenger joined or opened their account – if it was 2 weeks ago, it’s not them!

- Check that any email addresses they provide you end with ‘.gov.au’

- Check for typos in the message.

- Check the number of followers they have.

And remember, if you aren’t sure, go directly to the source (not the person who contacted you) and find out!